- Home to LMIC

- Virtual Labor Market Data System

- Career Exploration & Planning

- Consumer Price Index

- Demographics

- Economic Snapshot

- Employee Benefits

- Employment Projections

- Labor Force & Unemployment

- Labor Supply

- Overview of the Current Labor Market

- Surveys We Conduct

- Wages & Income

- Workers by Industry

- Tools & Resources

- Publications

- References

- What's New

- Can't Find It?

South Dakota e-Labor Bulletin

July 2024

South Dakota Industry Trends to 2032

South Dakota’s rate of employment growth (7.7%) to 2032 will outpace the nation (2.8%). Employment levels were projected for the 2022 to 2032 period using various statistical models incorporating historical employment data sets along with state and national economic trends.

As part of the nationally used projections methodology, a general assumption is made no major catastrophic events, national disasters, or pandemics that would significantly affect the economic activities of industries will occur during the projections period. Although talking about the COVID-19 pandemic’s impact on employment levels may play like a broken record, those impacts did register in historical employment data sets so are important to mention here since historical trends play a big part in the projections process. Many industries had unprecedented shutdowns during the second quarter of 2020, recording unusually low employment levels. But for the most part, those blips in historical employment data series were brief. In fact, recovery in most sectors and industries had already concluded by 2022, with businesses fully staffed and operational.

Several of the factors which contributed to the fast recovery from the pandemic continue to be at play and are expected to help prosperity continue in the future, including consumer demand, e-commerce, population growth, the needs of an aging population, and technological advances. South Dakota’s growth rate to 2032 is projected to outpace the nation. The total number of workers in South Dakota is projected to increase by 39,449 or 7.7% (0.77% annually) from 2022 to 2032, reaching 550,566 by 2032. On the national level, according to the U.S. Bureau of Labor Statistics (BLS), the total employment level is expected to reach about 169.1 million (0.3% growth annually) over the 2022-2032 decade.

Nationally, the projected 0.3% annual growth in the next ten years is less optimistic than the 1.2% annual growth rate experienced from 2012 to 2022. Projected employment growth is driven by labor force growth, which in turn is constrained by population growth. The population is projected to grow slower than in the previous decade, and the baby boom generation is increasing in age. The older age groups have a lower labor force participation rate than prime-age workers, therefore causing an overall labor force participation rate to decline.

The South Dakota projections include three categories of workers:

- Non-agricultural Self-employed and Unpaid Family Workers

- Agriculture, Forestry, Fishing and Hunting Workers (Farm Employment)

- Nonfarm Wage and Salaried Workers

| South Dakota Employment by Industry Division 2022-2032 |

||||

| Industry Division | 2022 Employment |

2032 Employment |

Actual Change |

Percent Growth |

| Total of All Divisions | 511,117 | 550,566 | 39,449 | 7.7% |

| Non-agricultural Self-employed and Unpaid Family Workers | 26,484 | 28,229 | 1,745 | 6.6% |

| Agriculture, Forestry, Fishing and Hunting (Farm Employment) | 33,331 | 34,941 | 1,610 | 4.8% |

| Nonfarm Wage and Salaried Workers (excludes Self-employed and Unpaid Family Workers) | 451,302 | 487,396 | 36,094 | 8.0% |

| Source: Labor Market Information Center, South Dakota Department of Labor and Regulation, July 2024. | ||||

The Nonfarm Wage and Salaried Workers category consists of only those wage and salaried workers who are covered under the South Dakota Reemployment Assistance program (unemployment insurance) and those who work for non-profit organizations, such as private colleges and religious organizations. Nonfarm wage and salaried workers compose the major element (88.3%) of South Dakota’s workforce. This group is also projected to have the highest growth rate to 2032 at 8.0%.

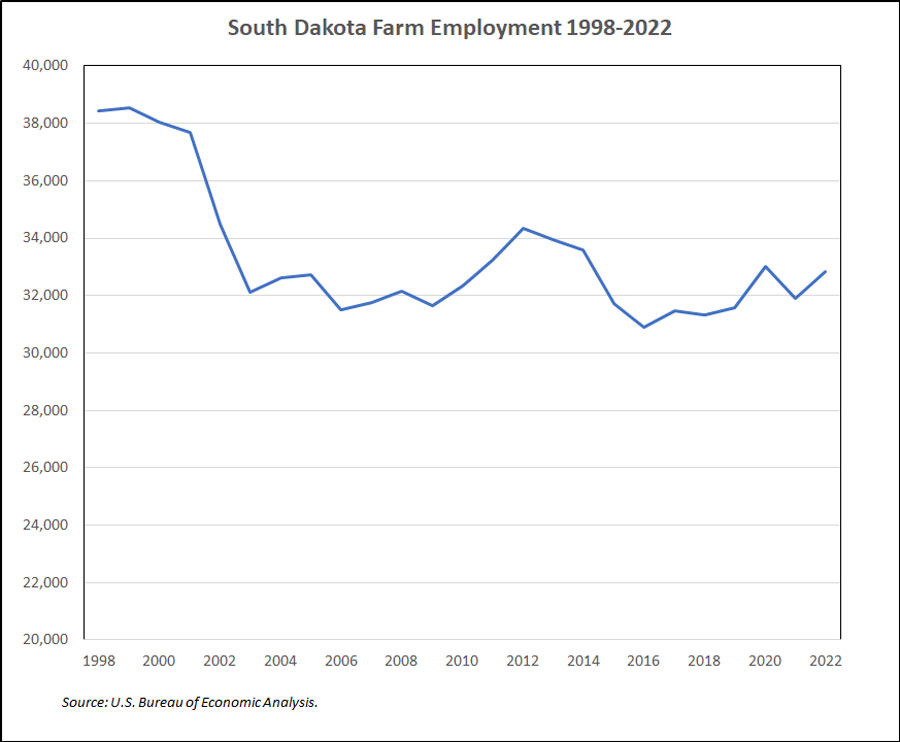

Another important element of South Dakota’s labor force is Agriculture, Forestry, Fishing, and Hunting (Farm Employment). This category is expected to grow slightly from 33,331 to 34,941 (4.8%) by 2032. It is projected to grow at 0.48% annually in the next decade. In the past, according to the U.S Bureau of Economic Analysis (BEA), South Dakota’s farm employment had been declining since the late 1990s and into the late 2000s; however, more recently South Dakota’s Farm Employment levels have steadied and are trending towards an uptick in workers. Over the past five years, the BEA-estimated Farm Employment went from 31,475 workers in 2017 to 32,848 workers in 2022, an increase of 1,373 workers. Nationally, employment in Farm Employment is expected to decrease slightly, by 57,500 jobs (0.3% annually) through 2032.

The final component of the workforce in South Dakota is the Non-agricultural Self-employed and Unpaid Family Workers category. According to BLS (based on the Current Population Survey and the American Time Use Survey), self-employed persons are individuals who work for profit or fees in their own business, profession, trade, or farm. This smallest portion (5.2%) of South Dakota’s workforce is expected to have a growth rate of 6.6% (0.66% annually) in the coming decade. On a national level, this category is expected to have annual growth of 0.1%.

Industries are categorized at several different levels of detail using the North American Industry Classification System (NAICS) coding structure. Each digit level represents a greater level of detail in how business activities are categorized. NAICS categorizes businesses into one of 20 supersectors at a two-digit level. For example, the two-digit code 72 represents the Accommodation and Food Services sector. Businesses are then classified into more specific categories within a sector, represented by codes of up to six digits. The more digits a code has, the more specific the business activity.

At the very broadest level, industry supersectors are categorized into one of two groups:

1. Goods-producing, including the following supersectors:

- Natural Resources and Mining

- Construction

- Manufacturing

2. Service-providing, including the following supersectors:

- Trade, Transportation, and Utilities

- Information

- Financial Activities

- Professional and Business Services

- Education and Health Services

- Leisure and Hospitality

- Other Services

- Public Administration

In 2022, the service-providing industries accounted for 74.1% of total employment in South Dakota. The service-providing industries are anticipated to employ 30,212 more workers by 2032, or an 8.0% increase in employment. Meanwhile, the goods-producing industries are expected to increase by 7,492 workers (7.1%). On the national level, BLS is expecting an increase of 4.6 million in service-producing industries, reaching over 136.7 million jobs by 2032.

Looking at national trends projected at the two-digit NAICS level, we learn employment in the Professional and Technical Services sector is projected to increase the fastest due to the demand for a range of services including accounting, engineering, and various computer services.

In South Dakota, the fastest-growing two-digit sectors are projected to be:

- Professional and Technical Services (15.2%)

- Health Care and Social Assistance (12.0%)

- Transportation and Warehousing (11.8%)

- Construction (11.5%)

- Arts, Entertainment, and Recreation (10.5%)

These fastest-growing sectors in South Dakota also contain seven of the top 10 industries at the more detailed, three-digit NAICS level which are projected to grow the fastest to 2032.

Let’s look at Construction for an example of how a two-digit NAICS industry sector is broken down into more detailed three- and four-digit industry levels. The two-digit Construction supersector NAICS 23 is broken down into more detailed three-digit subsectors:

- Construction of Buildings (NAICS 236)

- Heavy and Civil Engineering Construction (NAICS 237)

- Specialty Trade Contractors (NAICS 238).

Using Construction of Buildings (NAICS 236) from above, we’ll illustrate the further breakdown of businesses at the four-digit NAICS level:

- Residential Building Construction (NAICS 2361)

- Nonresidential Building Construction (NAICS 2362).

South Dakota Industry Subsectors Projected to Grow the Fastest to 2032

We ranked South Dakota’s industries at the three-digit NAICS level (subsectors) to see which are projected to grow the fastest from 2022 to 2032. The next section of this article will focus on those 10 industries. Only those industry subsectors with a minimum of 1,000 workers in 2022 were included.

| South Dakota Industry Employment Projections 2022-2032 Top Ten in Industry Growth |

|||||

| NAICS Code |

Industry Title | 2022 Employment |

2032 Employment |

Actual Change |

Percent Growth |

| 493 | Warehousing and Storage | 1,224 | 1,528 | 304 | 24.8% |

| 492 | Couriers and Messengers | 2,310 | 2,706 | 396 | 17.1% |

| 622 | Hospitals | 29,195 | 33,904 | 4,709 | 16.1% |

| 541 | Professional, Scientific, and Technical Services | 17,217 | 19,834 | 2,617 | 15.2% |

| 621 | Ambulatory Health Care Services | 19,257 | 22,032 | 2,775 | 14.4% |

| 336 | Transportation Equipment Manufacturing | 3,777 | 4,304 | 527 | 14.0% |

| 488 | Support Activities for Transportation | 1,089 | 1,224 | 135 | 12.4% |

| 326 | Plastics and Rubber Products Manufacturing | 1,617 | 1,813 | 196 | 12.1% |

| 238 | Specialty Trade Contractors | 15,537 | 17,368 | 1,831 | 11.8% |

| 423 | Merchant Wholesalers, Durable Goods | 11,077 | 12,365 | 1,288 | 11.6% |

Notes: Source: Labor Market Information Center, South Dakota Department of Labor and Regulation, July 2024. |

|||||

Warehousing and Storage

The number of workers in South Dakota’s Warehousing and Storage subsector is projected to increase by nearly a quarter 24.8% (304 workers) over the next 10 years. Businesses in this subsector are primarily engaged in operating warehousing and storage facilities for general merchandise, refrigerated goods, and other warehouse products. These fulfillment centers provide facilities to store goods and prepare for their shipment to consumers. A major factor in this projected growth is the continued demand for e-commerce goods. Consumer preferences have been trending more toward online shopping (spurred by the pandemic). As this demand continues, the need for more workers in this subsector will follow.

Couriers and Messengers

The Couriers and Messengers subsector is expected to increase by 17.1% (396 workers) by 2032. Businesses in this subsector provide intercity, local, and/or international delivery of parcels and documents. Consumer preferences push demand within this subsector as well. Consumers purchasing items online rather than in a brick-and-mortar store is an example. This subsector, along with Warehousing and Storage, has a direct relationship and will continue to see substantial growth in the years to come. Nationally, according to the BLS, growth in e-commerce is expected to drive employment growth in the Transportation and Warehousing sector. The BLS projects this sector to grow 0.8% annually from 2022-2032, adding close to 570,000 jobs. The Couriers and Messengers subsector together with the Warehousing and Storage subsector account for 80% of employment in the Transportation and Warehousing sector.

Hospitals

The Hospitals subsector is projected to increase by 16.1% (4,709 workers) over the next 10 years in South Dakota. This subsector is comprised of establishments providing medical, diagnostic, and treatment services and other specialized accommodations by inpatients. Hospitals may also provide outpatient services as a secondary activity. The demand for workers in hospitals is an ever-increasing need with a continued aging and increasing population. According to American Community Survey (ACS) one-year estimates from the U.S Census Bureau, South Dakota’s population 65 years and older increased by 16.9% from 2017 to 2022. Not only is the population increasing in terms of age, but it is also growing in numbers. Within the past five years (2017-2022), the U.S. Census Bureau estimated an increase of 4.6% (40,158 people) in South Dakota. The rising number of citizens will continue to drive demand for hospital workers.

Professional, Scientific, and Technical Services

South Dakota’s Professional, Scientific, and Technical Services subsector is projected to add 15.2% (2,617 workers) over the next decade. This subsector is comprised of establishments making available the knowledge and skills of their employees, often on an assignment basis, where an individual or team is responsible for the delivery of services to the client. The individual industries of this subsector are defined by a particular expertise and training of the service provider. Six of the nine more detailed, four-digit industries in this sector are expected to have double-digit percentage employment gains over the next 10 years. The largest increases are expected in Computer Systems Designs and Related Services along with Management, Scientific, and Technical Consulting Services, each projected to increase employment by more than 20%. Several factors are contributing to the need for workers within this subsector, including automation, technological advances, and the need for expertise and consulting. Retailers and fast-food chains are reducing labor costs through automation, like using self-checkouts and options to order online, through a phone app, or at a kiosk in the establishment.

Ambulatory Health Care Services

The number of workers in South Dakota’s Ambulatory Health Care Services subsector is projected to increase by 14.4% (2,775 workers) over the next 10 years. This subsector is comprised of entities providing health care services directly or indirectly to ambulatory patients. Inpatient services are not usually included. This subsector and hospitals are directly related, and employment growth is primarily driven by the same factors such as an aging population and population growth. At the four-digit industry level, Home Health Care Services, Outpatient Care Services, and Offices of Other Health Practitioners stand out above the rest in terms of projected growth, all contributing to this subsector’s position within the list of fastest-growing industries.

Transportation Equipment Manufacturing

Employment in the Transportation Equipment Manufacturing subsector is expected to increase by 14.0% (527 workers) by 2032. Establishments in the Transportation Equipment Manufacturing subsector produce equipment for transporting people and goods. These businesses use production processes similar to those of other machinery manufacturing establishments such as bending, forming, welding, machining, and assembling metal or plastic parts into components and finished products. Motor Vehicle Body and Trailer Manufacturing and Motor Vehicle Parts Manufacturing are the industries underneath Transportation Equipment Manufacturing are the driving forces behind the expected growth. Consumer demand in the past couple of years (2020-2022) drove increased production. According to the South Dakota Department of Revenue’s Sales and Use Tax Report, the annual gross sales for Transportation Equipment in South Dakota rose 64.4% from 2020 to 2022. As businesses and consumers continue to purchase products from establishments in this subsector (aerospace parts, motor vehicle parts and accessories, trailers, motorcycles, and boats) more workers are needed to increase production and meet the demand.

Support Activities for Transportation

South Dakota’s Support Activities for Transportation subsector is projected to add 12.4% (135 workers) over the next decade. Businesses within the Support Activities for Transportation subsector provide a wide array of transportation-related services, including air traffic control, marine cargo handling, and motor vehicle towing. Underneath this subsector, three out of four industries are projected to have double-digit percentage growth in the next decade. Support Activities for Transportation has a direct correlation with Transportation Equipment Manufacturing. As the need for higher production output continues, there will also be a need to ramp up staffing in these businesses providing related activities as well.

Plastics and Rubber Products Manufacturing

The number of workers in South Dakota’s Plastics and Rubber Products Manufacturing subsector is projected to increase by 12.1% (196 workers) over the next 10 years. Businesses in the Plastics and Rubber Products Manufacturing subsector make goods by processing plastic materials and raw rubber. Plastics and rubber are combined in the same sector because plastics are increasingly being used as a substitute for rubber; however, the subsector is generally restricted to the production of products made of just one material, either solely plastics or rubber. Gross sales have risen in the past couple of years in the Rubber and Miscellaneous Plastic Products major group, according to the Department of Revenue’s Sales and Use Tax Report. From 2020 to 2022 gross sales were up 37.9%. Manufacturing facilities within this subsector are continuing to increase production to keep up with increasing demand for products such as foam insulation, plastic bags, plastic pipes, plastic bottles, rubber tires, rubber hoses, and rubber belts.

Specialty Trade Contractors

The Specialty Trade Contractors subsector is projected to increase employment by 11.8% (1,831 workers) in South Dakota over the next decade. Businesses in this subsector perform a specific activity (such as preparing the site, pouring concrete, plumbing, painting, or performing electrical work) involved in building or other types of construction but are not responsible for an entire construction project. The work performed by specialty trade contractors is usually subcontracted from a general contractor or for-sale builder. Specialty trade contractors may also work directly for the owner of the property. This is especially true in the case of repair work and minor remodeling projects.

Three of the four industries housed under Specialty Trade Contractors are expected to have growth rates exceeding 10% in the next 10 years. Building Equipment Contractors are expected to lead the four-digit industries in growth; they install or service equipment that forms part of a building’s mechanical system such as electricity, water, heating, or cooling. The pandemic accelerated growth within this subsector as people spent more time at home (some working from home) and put greater emphasis on improvements and new construction.

Merchant Wholesalers, Durable Goods

The Merchant Wholesalers, Durable Goods subsector is projected to increase employment by 11.6% (1,288 workers) over the next decade. Businesses in this group sell capital or durable goods to other businesses. Durable goods are new or used items generally with a normal life expectancy of three years or more. The number of establishments in South Dakota’s Merchant Wholesalers, Durable Goods subsector doubled from 2012 to 2022. Consumer demand plays a large role in the continued and expected growth. This wholesale subsector encompasses a very broad range of durable goods, ranging from motor vehicles and machinery to furniture and construction materials. So as end consumers continue to need and want these greatly varied durable goods, driving the demand among the middle-level retailers who sell to those consumers, there will continue to be demand for workers in wholesale establishments.

Want more information?

For 2022 to 2032 projections data for additional industry subsectors or additional information about the projections methodology, please visit our Projections menu page.