- Home to LMIC

- Virtual Labor Market Data System

- Career Exploration & Planning

- Consumer Price Index

- Demographics

- Economic Snapshot

- Employee Benefits

- Employment Projections

- Labor Force & Unemployment

- Labor Supply

- Overview of the Current Labor Market

- Surveys We Conduct

- Wages & Income

- Workers by Industry

- Tools & Resources

- Publications

- References

- What's New

- Can't Find It?

South Dakota e-Labor Bulletin

February 2023

South Dakota Nonfarm Worker Trends in 2022

Unless otherwise noted, the following highlights are based on a comparison of annual average data for 2021 and 2022.

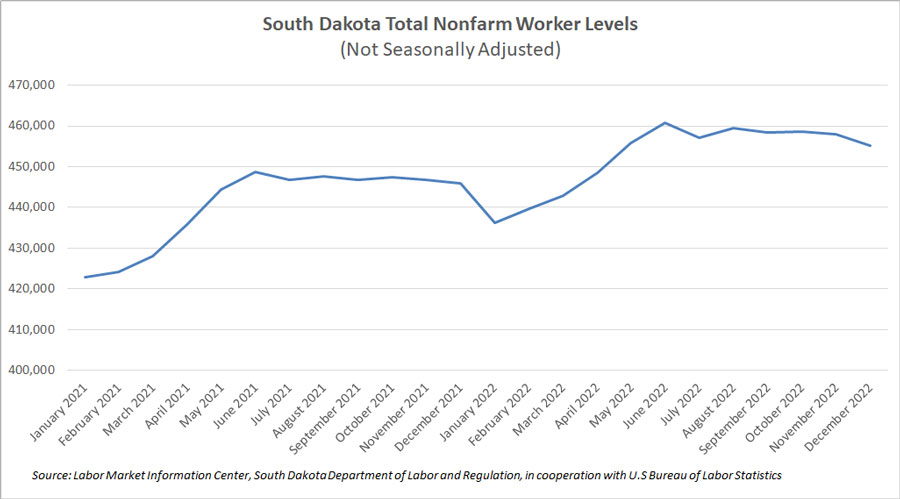

As we’ve mentioned countless times, 2020 was the year of worker loss due to COVID. Then 2021 was the year of recouping the workforce lost during COVID. The positive news for South Dakota continued, and 2022 was the year of substantial growth.

South Dakota’s nonfarm worker levels had significant gains during 2022, adding 12,100 workers (2.7%). The 2022 annual average number of workers was 452,500. Increases were spread throughout many of the industries in the state. The Sioux Falls Metropolitan Statistical Area (MSA) nonfarm worker level increased 5,400 workers (3.3%) for a 2022 annual average of 167,400 workers. The Rapid City MSA also had growth from 2021 to 2022, adding 2,600 workers (3.7%).

| South Dakota Statewide Nonfarm Wage & Salaried Workers by Industry (Not Seasonally Adjusted) |

||||

| Industry | 2021 Annual Average |

2022 Annual Average |

Actual Change | Percent Change |

| Total Nonfarm | 440,400 | 452,500 | 12,100 | 2.7% |

| Total Private | 361,600 | 372,800 | 11,200 | 3.1% |

| Goods Producing | 70,100 | 72,300 | 2,200 | 3.1% |

| Service Providing | 370,400 | 380,300 | 9,900 | 2.7% |

| Mining, Logging & Construction | 26,200 | 27,100 | 900 | 3.4% |

| Manufacturing | 43,900 | 45,100 | 1,200 | 2.7% |

| Wholesale Trade | 21,400 | 22,000 | 600 | 2.8% |

| Retail Trade | 51,600 | 53,000 | 1,400 | 2.7% |

| Transportation, Warehousing & Utilities | 13,900 | 14,300 | 400 | 2.9% |

| Information | 5,100 | 5,300 | 200 | 3.9% |

| Financial Activities | 28,200 | 28,000 | -200 | -0.7% |

| Professional & Business Services | 34,600 | 36,700 | 2,100 | 6.1% |

| Private Education & Health Services | 74,200 | 75,300 | 1,100 | 1.5% |

| Leisure & Hospitality | 45,600 | 48,300 | 2,700 | 5.9% |

| Other Services (except Public Administration) | 17,000 | 17,700 | 700 | 4.1% |

| Government | 78,900 | 79,700 | 800 | 1.0% |

| Note: Numbers may not add due to rounding. | ||||

| Source: Labor Market Information Center, South Dakota Department of Labor and Regulation, in cooperation with U.S. Bureau of Labor Statistics | ||||

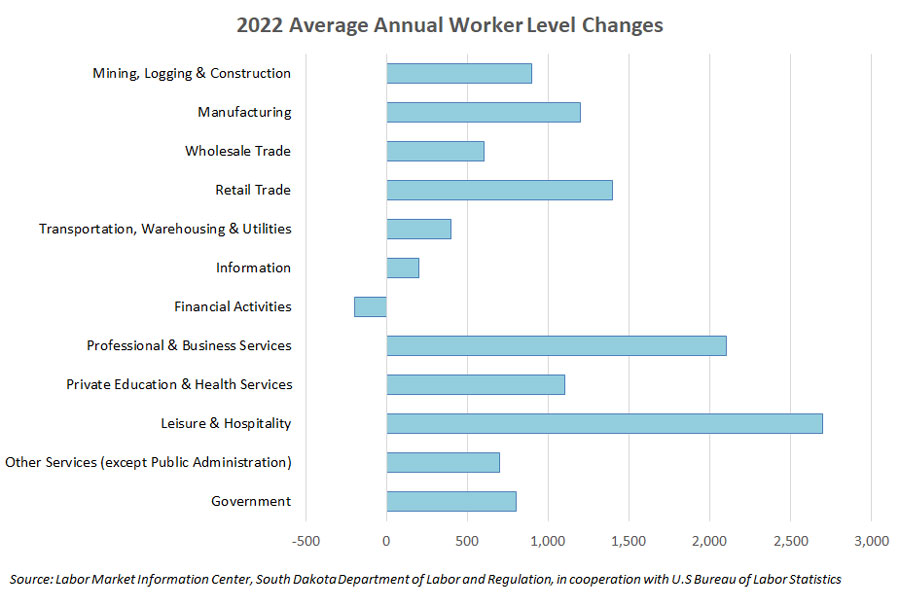

The total nonfarm worker levels mentioned above can be divided into two major components: Goods Producing and Service Providing industries. Goods Producing industries (Mining, Logging and Construction sector and the Manufacturing sector), increased by 2,200 workers (3.1%) from 2021 to 2022. Service Providing industries (all other sectors listed in the table above) gained 9,900 workers (2.7%). In both cases, 2022 growth was noteworthy compared to average over-the-year gains the last decade. Annual worker growth in Goods Producing industries had averaged just 1,000 since 2012 until this year brought double that growth. Meanwhile, growth in service-producing industries had averaged 2,900 a year, further underlining the significance of the 2022 growth.

Mining, Logging and Construction added 900 workers (3.4%), reaching a 2022 annual average of 27,100 workers. The Sioux Falls MSA added 500 workers and the Rapid City MSA increased 200. The growth was concentrated in Construction, which added 900 workers (3.6%) throughout the state. Specialty Trade Contractors accounted for most of the growth in Construction with the addition of 700 workers (4.8%). Specialty Trade Contractors account for just under 60% of the workforce in Construction with an annual average of 15,400 workers in 2022. Specialty Trade Contractors perform a specific activity, such as site preparation, pouring concrete, plumbing, painting or doing electrical work. Construction of Buildings also had growth on a smaller scale, adding 200 workers (3.3%). Heavy and Civil Engineering had a modest loss of 100 workers (2.3%). The demand for workers in Construction increased in 2022, with many new commercial and residential projects underway. Apartment complexes, strip malls, home renovations and road improvements are just a few examples of the updates you will see throughout the state. According to the City of Sioux Falls, the construction valuation totaled $1.9 billion in 2022, which is a significant increase from the 2021 total construction valuation of $1.1 billion. Mining and Logging added 100 workers (9.1%) from 2021 to 2022, reaching 1,200 workers. Over the last ten years, Mining and Logging has been very stable with modest changes from year to year.

Manufacturing increased 2.7% with the addition of 1,200 workers. This sector went from 43,900 workers in 2021 to 45,100 workers in 2022. In 2022, Manufacturing recouped the workforce lost during the pandemic and surpassed the 2019 annual average of 45,000 workers. Most of the growth (75%) took place outside of the Sioux Falls and Rapid City MSAs. Durable Goods accounted for most of the growth within Manufacturing, adding 1,100 workers (4.0%). With a 2022 annual average of 28,400 workers, Durable Goods accounts for just over 60% of the workforce in Manufacturing. Durable Goods produced in South Dakota, such as trailers, furniture and electronic equipment, are not immediately consumed and can be kept for a longer time. Non-Durable Goods Manufacturing added 100 workers (0.6%) from 2021 to 2022. Non-durable goods are immediately consumed in one use or have a lifespan of less than three years. Examples of non-durable goods produced or processed in South Dakota include food and beverage products, paper products and fuel. Product demand drives the growth within Manufacturing. As demand increases, establishments in Manufacturing build up their workforce to meet that demand. Growth was spread throughout many of the establishments in the sector.

Wholesale Trade gained 600 workers (2.8%), reaching a 2022 annual average of 22,000 workers. The Wholesale Trade sector consists of establishments engaged in wholesaling merchandise and rendering services incidental to merchandise. The wholesaling process is an intermediate step in product distribution. Wholesalers sell merchandise received from manufacturers to other establishments and normally operate from a warehouse or office. The growth of Wholesale Trade correlates with the growth of Manufacturing. The more product there is to sell, the greater need there is for wholesalers.

Retail Trade continued on an upward climb, adding 1,400 workers (2.7%) in 2022. The Sioux Falls and Rapid City MSA each added 500 workers over the year. With a 2022 annual average of 53,000 workers in the state, this sector employs 11.7% of the nonfarm workforce. Establishments in Retail Trade employ many part-time workers, many juggling work schedules around school or another job. Clothing boutiques, home furnishing stores, department stores, hardware stores, supermarkets, gasoline stations, antique shops and souvenir stores are examples of establishments in this sector. The retail landscape has evolved over the last 10 years. Establishments continue to expand the shopping experience whether the consumer is shopping in the store, online or using a phone app. From game nights, bucket sales or sales drops at certain times, establishments aim to increase consumer traffic by organizing events both online and in the store. Options for shopping have continued to evolve as consumers are able to use multiple avenues for purchasing and receiving products. In some cases, consumers have continued to rely on the convenience of options initiated during the COVID-19 pandemic for public health reasons, with ongoing and growing demand for those services. One noteworthy example is discount stores and large grocery stores having staff who “pick” orders for customers, then offering curbside or parking lot pick-up. As consumer demand for these various practices continues to grow, so does the need for additional staff.

Transportation, Warehousing and Utilities worker levels increased 400 workers (2.9%), jumping to 14,300 workers in 2022. Examples of establishments in this industry include tow truck services, natural gas distribution, taxicab services, local and long-distance trucking, scheduled air passenger transportation and general warehousing. A person does not have to look far before they see a semi-truck transporting goods to an establishment or a courier delivering packages to the neighborhood. Many establishments rely on transportation and warehousing companies to move products from the manufacturer to the consumer. Growth in Transportation, Warehousing and Utilities is due to increases in demand, which also increases the need for workers.

Information added 200 workers (3.9%), reaching a 2022 annual average of 5,300 workers. This is the first year of growth after worker levels trended downward over the last 10 years. Growth in this sector took place outside of the Sioux Falls and Rapid City MSAs. The Information sector is comprised of establishments engaged in publishing, internet publishing, motion picture and sound recording, broadcasting, movie theaters, internet service providers, data processing and all other information services. Increases are related to establishments’ continued efforts to regain some of the workforce lost during the pandemic. Establishments in this sector have recouped 96.3% of the worker levels they averaged in 2019 (5,500 workers). Through the Quarterly Census of Employment and Wages (QCEW) program which provides more detailed data than the monthly establishment survey, we've noticed an uptick of workers in the motion picture and sound recording industries subsector and the data, processing, hosting and related services subsector from the first quarter of 2021 to the third quarter of 2022.

Financial Activities had a loss of 200 workers (0.7%), dropping to a 2022 annual average of 28,000 workers in South Dakota. Over half of the workers in the Financial Activities supersector are in the Sioux Falls MSA (15,200 workers). The Financial Activities supersector consists of the Finance and Insurance sector and the Real Estate and Rental and Leasing sector. Credit card banks, saving institutions, portfolio fund managing, insurance claims adjusting, real estate agencies, residential property management and home health equipment rental are examples of establishments in this supersector. Establishments in Financial Activities have continued to evolve with advances in technology and increased automation. While the need for activities in this supersector remains strong, worker levels had a modest loss due to technology advancements. Consumers are able to complete most transactions without setting foot in an establishment. Whether you are researching houses on the market, viewing apartment complexes or filling out an application, there are many options to do so online. The demand for online banking has also grown as consumers transition away from traditional banking methods. Many services have been simplified, resulting in time-saving processes that have kept worker level changes small.

Professional and Business Services increased 6.1% over the year with the addition of 2,100 workers in 2022. The Sioux Falls MSA added 1,100 workers over the year, while the Rapid City MSA added 500. The Professional and Business Services supersector is broken down into the following sectors: Professional, Scientific and Technical Services; Management of Companies and Enterprises; and Administrative and Support and Waste Management and Remediation Services. Computer hardware consulting services, payroll processing services, landscaping services, tax preparation services, corporate offices primarily engaged in overseeing a company and security guard services are examples of establishments in this supersector. This type of growth indicates other businesses are growing at a rate where additional professional services are required. Data from the QCEW program indicate gains are spread throughout many establishments in this supersector, with many new establishments added in 2022.

Private Education and Health Services added 1,100 workers (1.5%) in 2022. This growth took place primarily in the Sioux Falls MSA (900 workers). Health Care and Social Assistance accounted for most of the growth in Private Education and Health Services, adding 800 workers (1.2%). Establishments in Health Care and Social Assistance include dentist offices, chiropractors, childcare centers, assisted living facilities and vocational rehabilitation agencies. Hospitals added 400 workers (1.5%) from 2021 to 2022, reaching 27,900 workers. Health Care and Social Assistance worker levels have had consistent growth over the years. This growth is related to increases in population and medical advancements, both increasing the need for workers. The U.S. Census Bureau estimated South Dakota’s population at 909,824 in July 2022 compared to 896,164 in July 2021. Continued growth in Health Care and Social Assistance is essential to keep up with the demand of an aging population.

Private Educational Services gained 300 workers (4.3%), reaching an annual average of 7,200 workers in 2022. This number includes private educational services; public educational services are included in government worker levels. The Educational Services sector is made up of establishments that provide instruction and training in a wide variety of subjects.

Leisure and Hospitality had significant growth from 2021 to 2022, adding 2,700 workers (5.9%). Leisure and Hospitality remained strong in 2022 despite rising costs. South Dakota is a great destination for out- of-state travelers or for those looking for a staycation. According to the South Dakota Department of Tourism, 14.4 million visitors traveled to South Dakota in 2022 compared to 14.3 million visitors in 2021. As visitor levels increase so does the need for additional workforce. Establishments included in this supersector include performing arts, fitness centers, museums, parks, hotels and restaurants.

Other Services (except Public Administration) worker levels increased 700 workers (4.1%). This sector went from an annual average of 17,000 workers in 2021 to an annual average of 17,700 workers in 2022. Examples of establishments in this sector include beauty salons, car washes, wedding planning services, civic and social organizations, general automotive repair shops and pet boarding services. Increased population growth drives the demand for services provided in this sector.

Government gained 800 workers (1.0%), reaching a 2022 annual average of 79,700 workers. Local Government accounted for most of the growth in Government, adding 1,000 workers (2.0%). Tribal, city and county governments, along with public and tribal school districts, are included in Local Government. Local Government Educational Services added 700 (2.7%). Gains in Local Government can be tied to increases in population. As the population rises, city programs and services also expand to meet the needs of the community. State Government remained unchanged from 2021 to 2022 with an annual average of 17,600 workers. Federal Government had a loss of 300 workers (2.6%), dropping to a 2022 annual average of 11,200.

What will happen to nonfarm worker levels in 2023 in light of rising costs and interest rates amid declining demand in some industries? Only time and the continuation of labor market data series like nonfarm wage and salaried worker levels will tell.