Reemployment Assistance Tax

Frequently Asked Questions

I am an out-of-state employer. When am I required to report to South Dakota?

Do I have to pay state reemployment assistance if I already pay federal unemployment?

What happens once I've submitted my registration?

What happens if I register, but also have previous quarterly wage reports due?

What is the Reemployment Assistance taxable wage base?

What is an independent contractor?

Are day laborers or casual labor reportable for reemployment assistance?

Do I have to report corporate officer wages?

What records must an employer keep?

Should wages be reported in the quarter they are earned or the quarter paid?

Does South Dakota accept electronic fund transfers (EFT) or credit cards?

Does South Dakota allow common paymasters?

Can I obtain federal unemployment forms from the South Dakota Reemployment Assistance Tax Unit?

How do I change my address? Employer Change of Address Form

Do I need to register?

Yes. All new and acquired businesses in South Dakota are required to register with the Reemployment Assistance (RA) Tax Unit. Registration is also required for an existing account if the entity or ownership of the business has changed. For example, a sole proprietorship forms a partnership or a partnership forms a corporation.

How do I register?

It is your responsibility to complete a registration form. You may register online at Register Your Business, or forms are available online on our Forms page. You can also obtain a form by calling the Reemployment Assistance Tax Division at 605.626.2312.

Most businesses need to complete a Registration Form 1. Special registration forms are also available for 501(C)(3) organizations (Form 1NP) and political subdivisions (Form 1PS).

If you are a domestic employer and want to report annually, submit Form DE - Domestic Employer Application to Report and Pay Annually - by December 31st to be effective the following calendar year.

To submit your completed form by mail:

Reemployment Assistance Division - Tax Unit

SD Department of Labor and Regulation

P.O. Box 4730

Aberdeen, SD 57402-4730

Or fax it to:

605.626.3347

It is important that you complete all information on the registration form. Incomplete registrations will be returned. This will delay processing time and may cause your taxes to become delinquent.

Do I have to pay RA taxes?

Employers are subject to reemployment assistance (RA) tax if they meet one of the following criteria:

- Employed one or more individuals (full- or part-time) in 20 different calendar weeks in the current or preceding calendar year;

- Paid wages of $1,500.00 or more in a calendar quarter in the current or preceding calendar year;

- Are covered under Federal Unemployment Tax Act (FUTA) and unemployment insurance laws of another state;

- Acquired all or a portion of a covered business;

- Paid wages for agricultural employment of $20,000 or more in a calendar quarter or employed 10 or more individuals for some portion of a day in each of 20 different calendar weeks in the current or preceding calendar year;

- Paid wages for domestic employment of $1,000 or more in a calendar quarter in the current or preceding calendar year; or

- Have proof of 501(c)(3) non-profit status with IRS and employed four or more individuals in 20 different calendar weeks in the current or preceding calendar year.

I am an out-of-state employer. When am I required to report to South Dakota?

South Dakota residents who work for you in South Dakota (regardless how long they work for you) and out-of-state employees working in South Dakota more than 90 days should be reported to South Dakota. Out-of-state employees working in South Dakota fewer than 90 days should be reported to your home state.

South Dakota residents who work in another state should be reported to the state where the work is being performed, not South Dakota. If their work is not localized in one state, such as truck drivers and salespeople, they should be reported to the state where they receive their direction and control. Do not report based on residency. Report based on where the work is being performed.

Do I have to pay state reemployment assistance if I already pay federal unemployment?

Yes. In most cases, paying state reemployment assistance actually works to your advantage. If you are current with your state reemployment assistance (reports and taxes), you are allowed to take a credit against your federal unemployment. This credit reduces the federal unemployment you pay from 6.0% to 0.6%.

What happens once I've submitted my registration?

If you register online, you will receive your account number and tax rate immediately if you are subject to the tax.

Registration forms submitted by mail, fax, e-mail, or in-person can take approximately two to three weeks to assign an account number and tax rate. This information will be mailed to you along with a Notice of Liability in a new employer's packet.

What happens if I register, but also have previous quarterly wage reports due?

If you are submitting a registration now, but realize that you were liable for previous quarters you should either:

- Print the Quarterly Wage Report and mail it along with your registration. See the tax rates tables below for the correct tax rate to use. or

- Call the Reemployment Assistance Tax Unit at 605.626.2312 to have a report faxed or e-mailed to you. or

- Fax a request to the Reemployment Assistance Tax Unit at 605.626.3347 to have a report faxed to you. or

- Contact your local Tax Representative using the contact information on our field locations page.

If you wait to have the wage report mailed to you with an account number, you may incur additional penalties and interest.

What is my tax rate?

If your business is new, see the table below.

| New Employer Tax Rates | ||||

| RA Tax | Investment Fee | Administrative Fee | ||

| Non-Construction | Construction | |||

| Year 1 | 1.20% | 6.00% | 0.55% | Not Applicable |

| Years 2 & 3 | 1.00% | 3.00% | 0.55% | Not Applicable |

| (*Applies to those with a positive account balance.) | ||||

If your business has been established for more than three years, see the rate information below.

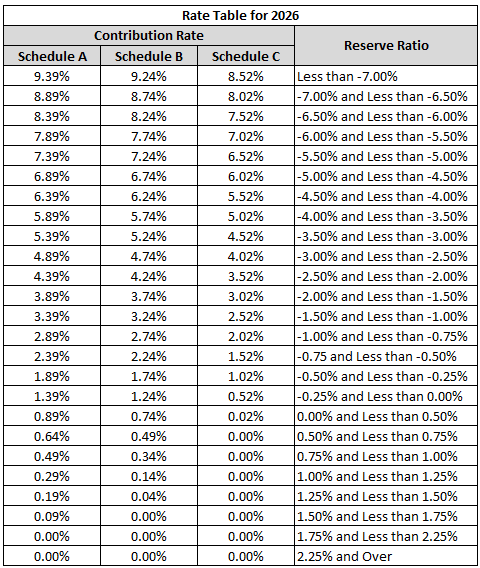

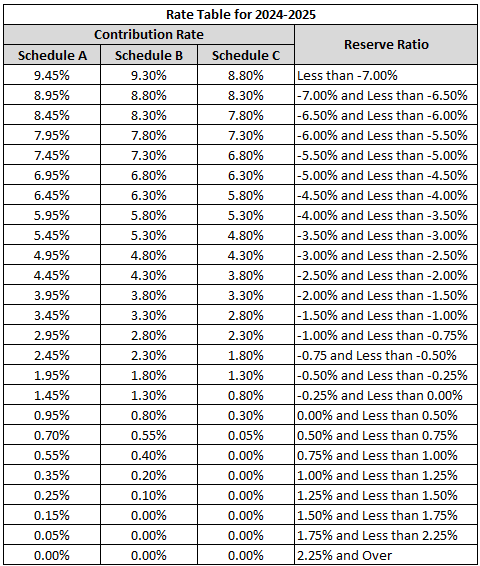

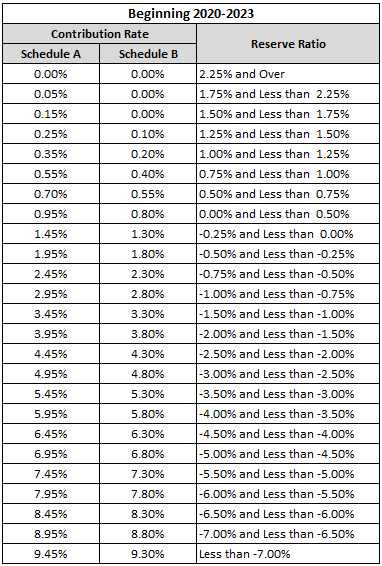

After three years of employment, each employer's rate is calculated annually and is based on prior wages reported and reemployment assistance claims. The rate is based on the reserve ratio, which is a measure of the balance in the reemployment assistance account compared to taxable payroll for the prior three fiscal years ending on June 30. The reserve ratio is determined by dividing the balance in the experience rating account by the total taxable payroll for the three prior fiscal years ending on June 30. The following are reserve ratios and corresponding rates (See South Dakota Codified Law (SDCL) 61-5). South Dakota law also contains a "hold harmless" clause. It provides that your investment fee rate can be no greater than your 1987 fee rate, if your account had a positive balance at the end of the last two years.Administrative Fee

Each employer eligible for experience-rating as defined in law (SDCL 61-5-24) shall pay an administrative fee on wages. For calendar year 2026 and each year thereafter, an administrative fee of eight-hundredths percent (.08%) or .0008 must be paid by the employer. For calendar year 2025 and 2024, if the employer’s reserve ratio is less than two and one-quarter percent, an administrative fee of two hundredths percent (.02%) or .0002 shall be paid. No administrative fee may be credited to the employer’s experience-rating account or deducted in whole or in part by any employer from the wages of individuals in its employ.

The contribution rates provided in this section apply to taxable wages paid on and after January 1, 2026.

An additional surcharge is a permanent part of South Dakota law; it automatically goes into effect when the UI Trust Fund balance is below $11 million at the end of any quarter. There has not been a surcharge since third quarter 2010. Should a surcharge become effective at a future date, all affected employers will be notified by mail.

What is the Reemployment Assistance taxable wage base?

Employers must report all wages paid to each employee in each quarter on their quarterly reports; however, tax is only assessed on each employee's wages up to the annual taxable wage base per calendar year. Individual employee wages greater than the annual taxable wage base are considered "excess wages" (i.e., wages in excess of the employee's annual base wage).

| Taxable Wage Base* | ||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 & after |

| $9,500 | $10,000 | $11,000 | $12,000 | $13,000 | $14,000 | $15,000 |

*All rates and wage bases subject to change by the South Dakota Legislature.

What is an independent contractor?

Services performed by an individual for remuneration is covered employment unless the following two conditions are met, per South Dakota Codified Law 61-1-11:

- The worker is free from control or direction of the performance of the contract for services, and

- The worker must be engaged in an independently established trade, occupation, or business.

Are day laborers or casual labor reportable for reemployment assistance?

Yes. South Dakota statute requires all employment be reported, regardless of length of employment.

Do I have to report corporate officer wages?

Corporate officers are considered employees for reemployment assistance tax purposes. When a shareholder employee of a corporation provides services to the corporation, reasonable compensation generally needs to be paid. Reasonable compensation to shareholder employee(s) must be declared before a non-wage distribution may be made to that shareholder employee. This compensation is subject to reemployment assistance taxes.

What records must an employer keep?

For each employee, you should have the following records:

- Full name and social security number;

- Places of work within South Dakota;

- Date hired, rehired, or returned to work after temporary or partial layoff;

- Date of termination of employment;

- Information covering the termination, including if the termination occurred by voluntary action of the individual, or by discharge, and complete reason for the termination;

- The cause of all time lost due to unavailability for work occurring within any week;

- Hours worked and wages earned in each pay period, and the total wages for all pay periods ending in each quarter of the year, including the cash value of the other remuneration, and the amount of all bonuses or special commissions;

- Hours worked and wages earned in exempt employment.

Should wages be reported in the quarter they are earned or the quarter paid?

All wages are to be reported in the calendar quarter they are paid to the worker.

Does South Dakota accept electronic fund transfers (EFT) or credit cards?

Yes. You have the option of paying your amount due using Electronic Funds Transfer (EFT) when you report online. EFT payments are only accepted at the time you file your quarterly report.

Credit Card payments are accepted for outstanding debts, but cannot be used when filing your quarterly report.

Does South Dakota allow common paymasters?

The state of South Dakota will recognize common paymasters (related corporations or companies reporting all payroll under one account). A common paymaster situation exists when two or more related companies concurrently employ the same individual and one of the corporations compensates the individual for the concurrent employment. Payrolling is NOT allowed. Payrolling is the practice of an employing unit paying wages to the employees of another employer or reporting those wages on its payroll tax reports. Often, under this arrangement, the “payrolling” corporation processes the payroll information and issues the paychecks to all employees. However, it is customarily reimbursed by the related or subsidiary corporations not only for the wages, but also for the employer share of federal payroll tax expenses. The “payrolling” corporation may also receive a processing fee.

Application and Affidavit forms can be found on the Forms page under Additional RA Tax Forms.

Can I obtain federal unemployment forms from the South Dakota Reemployment Assistance Tax Unit?

No. We are a state agency and do not have the federal unemployment forms (Form 940). You must contact the Internal Revenue Service (IRS). They may be reached at 800.829.4933 or through a local IRS office. All IRS forms are also available on their website at www.irs.gov. They will also be able to answer any questions you have on these forms.

What is negative interest?

Starting in 2009, employers with an experience rating account which has a negative balance may be assessed interest on the negative balance.

Background

In 2006, the South Dakota Legislature adopted a comprehensive package to put the South Dakota Unemployment Insurance Trust Fund on a path to improved solvency. One of the pieces was an assessment of interest on experience-rating accounts that have maintained a negative balance.

The South Dakota Unemployment Insurance Trust Fund is held by the U.S. Treasury, where it earns interest. In 2007, the average interest earned was 4.82 percent. The South Dakota Legislature decided that employers whose experience-rating account balances were negative and had become more negative compared to the balances as of December 31, 2006 will be charged interest equivalent to the interest rate earned by the Trust Fund.

Details

For those employers whose experience-rating account has had a negative balance at the end of each quarter for the last two calendar years and whose balance is more negative now than it was as of December 31, 2006, their account will be assessed interest at a rate equal to the rate the U.S. Treasury pays on the Trust Fund.

During February of each year, those employers will receive notice of interest due. The interest is payable in four equal payments due on the last day of each quarter. Effective July 1, 2011, this interest payment is credited to your Unemployment Insurance Experience-Rating Account. Negative account balances prior to December 31, 2006 will be not charged.

Example

If your account balance at rating time for the 2009 tax rates is a negative $2,000 and if your account balance on December 31, 2006 was a negative $1,000, you will pay interest on the $1,000 difference. The average 2008 interest rate earned by the Trust Fund (4.78 percent) times $1,000 equals $47.80. Rate schedules for employers who maintain a positive account balance will not change.

If you have additional questions not answered above, please contact us. You may also contact your local tax representative using the information on our Field Locations page.